Do you want more money back from the IRS this year?

According to the IRS, over $1 billion remains unclaimed by taxpayers. Many U.S. taxpayers miss out on credits, skip filing, or make small filing mistakes that cost them money.

With the right steps, tax season becomes an opportunity to reclaim more of your hard-earned money.

In this guide, we’ll help you legally maximize your tax refund in 2025, whether you’re saving for a goal, paying off debt, or just want to stop leaving money on the table.

Best Ways to Maximize Your Tax Refund This Year

While many people use standard tax tips, you can do even more to boost your refund. Here are actionable steps to help you maximize tax refund.

Choose the Right Filing Status

Your filing status directly affects how much tax you owe and what credits or deductions you qualify for.

There are five IRS-recognized statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying surviving spouse

Head of Household status offers a higher standard deduction and better tax brackets than the Single filing status. If you support a dependent (child or elderly parent), you may qualify.

In some cases, Married Filing Separately can increase deductions, especially if one spouse has high medical expenses.

Do the math or consult a pro to find the status that helps you maximize tax refund.

Contribute to Tax-Advantaged Accounts

One of the smartest ways to maximize tax refund amounts is through contributions to tax-advantaged accounts. These reduce your taxable income directly:

- 401(k): In 2025, you can contribute up to $23,000 (plus $7,500 more if you’re 50+).

- Traditional IRA: Contributions are deductible if you qualify.

- Health Savings Account (HSA): Triple tax advantage-contributions are deductible, growth is tax-free, and withdrawals for medical expenses aren’t taxed.

- 529 college plans: Some states offer deductions for contributions.

These accounts not only reduce what you owe but also help build your financial future.

Adjust Your Withholding Strategically

If you consistently get large refunds, it means you’re overpaying the IRS throughout the year.

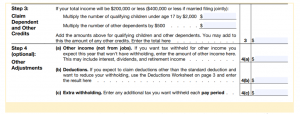

- By adjusting your W-4 (especially “Step 3: Claim Dependent and Other Credits” and “Step 4 (optional): Other Adjustments”), you can have that money included in your paycheck instead of waiting for a refund.

- On the other hand, increasing your withholding might make sense if you’re self-employed or have other income sources.

Either way, adjusting it correctly is part of smart income tax planning.

Must-know Tax Deductions 2025 to Boost Your Refund

Tax deductions reduce your taxable income. Knowing which ones you qualify for in 2025 can result in a significantly larger refund.

Below is a quick-reference table of the most valuable tax deductions you shouldn’t miss this year.

| Tax Deduction | Eligibility/Criteria | 2025 Deduction Details |

| Standard deduction | Based on filing status |

|

| Student loan interest | Paid interest on qualified student loans | Up to $2,500 deduction (phases out based on income) |

| IRA contributions (Traditional IRA) | Contributions to a retirement account | Up to $7,000 (or $8,000 if age 50+) deductible, depending on income and coverage by work plan |

| Health Savings Account (HSA) contributions | Must have a high-deductible health plan (HDHP) | Up to $4,150 for self-only and $8,300 for family coverage (with $1,000 catch-up for age 55+) |

| Medical & dental expenses (Itemized) | Must exceed 7.5% of Adjusted Gross Income (AGI) | Deduct expenses above the 7.5% AGI threshold |

| Charitable contributions | Cash or property donated to qualified organizations | Typically up to 60% of AGI, but documentation required |

| Educator expenses | K–12 teachers, counselors, principals | Up to $300 per educator (or $600 if married and both qualify) |

| Home mortgage interest (Itemized) | On loans up to $750,000 taken after Dec 15, 2017 | Full interest deduction within IRS limits |

| State and Local Taxes (SALT) (Itemized) | Property, state income, or sales taxes paid | Deduction capped at $10,000 ($5,000 if MFS) |

| Business use of home | Self-employed individuals using part of home for business | Portion of home expenses (mortgage, rent, utilities) deductible |

| Self-employment deductions | Self-employed individuals | Deduct health insurance, 50% of self-employment tax, retirement contributions |

| Moving expenses | Only for active-duty military members moving due to a change of station | Actual costs of moving household goods and travel |

| Penalty on early withdrawal of savings | If you withdrew money early from a CD or similar savings | The penalty amount is deductible |

| Alimony payments (Pre-2019 agreements only) | Divorces finalized before Jan 1, 2019 | Fully deductible for the payer |

| Casualty & Theft Losses (Itemized) | In federally declared disaster areas | Only losses exceeding 10% of AGI and not reimbursed by insurance |

| Opportunity Zone Investment | Investments in designated Opportunity Zones | May defer or reduce capital gains taxes |

Don’t Forget About Timing

When you do things is just as important as what you do. Here’s how timing can help increase your refund:

- Making your January mortgage payment in December.

- Scheduling a doctor’s visit in late December instead of early January.

- Donating to charity before December 31.

- File electronically with direct deposit to speed up your refund.

- Contribute to an IRA before the April 15 deadline and still have it count for 2024.

This kind of year-end planning can add valuable deductions, helping you maximize tax refund outcomes.

Read: How Many Years Can You Go Without Filing Taxes?

Most Valuable Tax Credits for Individuals to Increase Your Refund

Unlike deductions, tax credits directly reduce your tax bill. Some tax credits are even refundable, meaning you can get money back even if you owe nothing.

Top tax credits for individuals in 2025 include:

- Earned Income Tax Credit (EITC): Up to $7,830 for low- to moderate-income earners.

- Child Tax Credit: Up to $2,000 per child under 17.

- Child and Dependent Care Credit: Up to $6,000 for qualifying expenses.

- American Opportunity Tax Credit & Lifetime Learning Credit: If you or your child are in college, you can get up to $2,500 back for college-related expenses.

- Saver’s Credit: If you have contributed to retirement, you might get a credit of up to $1,000 for low- and moderate-income workers saving for retirement.

These credits are powerful tools for federal tax refund optimization. Missing out on even one of these tax credits for individuals can reduce your refund by thousands.

Avoid these filing mistakes that lower refunds

Below are overlooked mistakes that could shrink your return or trigger delays. Use this list as a checkpoint to maximize tax refund potential and avoid regrets.

Avoid these refund-killing mistakes:

- Misreporting digital income: Payments from apps like Venmo or freelance gigs or cryptocurrency must be reported. The IRS matches 1099s and payment platforms.

- Skipping itemization analysis: Compare itemized deductions with the standard deduction; you might save more by itemizing.

- Wrong filing status: Filing as Head of Household or Qualifying Widow(er) may offer bigger deductions than Single or Joint.

- Forgetting above-the-line deductions: HSAs, student loan interest, and IRA contributions lower your AGI, unlocking more credits.

- Typos in routing or SSNs: Small entry mistakes can delay refunds or void credits tied to dependents.

- Incorrect dependent claims: Ineligible dependents or missed ones can affect credits like EITC and Child Tax Credit.

- Missing timing strategy: Late charitable donations or expenses won’t count, year-end planning matters.

- Overlooking state tax effects: Some federal deductions are not allowed by your state, affecting your net refund.

- Incorrect investment cost basis: If untracked, the IRS assumes zero cost, increasing your taxable gains.

- Filing too early: Updated W-2s or 1099s may come later; early filing can lead to errors and amendments.

According to the IRS, errors like these delay or lower refunds every year. Be extra careful or hire a pro.

Smart Tax Refund Strategies for Self-Employed Taxpayers

If you’re a freelancer, gig worker, or business owner, you have more ways to boost your refund.

Here’s how to maximize tax refund when you’re self-employed:

- Classify income types like consulting, affiliate, or royalties separately. It helps you track earnings and unlock precise deductions.

- Use the QBI deduction (up to 20%) if eligible. Restructure income or file jointly to stay under the thresholds.

- Prepay expenses like subscriptions or services in December. This boosts deductions and helps you maximize tax refund totals.

- Fund a Solo 401(k) or SEP IRA. These allow high contributions and slash taxable income dramatically.

- Claim your home office using actual expenses for larger deductions, utilities, repairs, and even depreciation.

- Apply the Augusta Rule by renting your home to your business for 14 tax-free days per year.

- Use dedicated accounts to separate personal and business spending for stronger, audit-proof records.

- Carry forward business losses to reduce future tax bills using Net Operating Loss (NOL) rules.

- Buy deductible business tools and software, then claim Section 179 or bonus depreciation benefits.

- Put your spouse or teen on payroll to lower your tax bracket and create family wealth.

- Deduct your health insurance premiums if you’re self-employed and not eligible for a workplace plan.

- Track all business-related mileage, even small trips. Use apps to capture every deductible mile.

- Delay invoices until next year if on cash-basis accounting to push income to the next tax year.

These are simple but powerful tax refund tips for self-employed people who want to win at tax time.

Maximize Your Tax Refund with Professional Help

DIY filing has a cost, and tax software often leaves money behind. Because it doesn’t ask the right questions.

Hopkins CPA Firm goes beyond forms.

Our team:

- Look for credits and deductions that most software misses

- Help structure your income to reduce AGI

- Filing accurately, reducing delays, or IRS audits

- Correct past-year mistakes (which can still be amended for refunds)

If you run a business, our tax preparation ensures you never overpay.

With Hopkins CPA, you don’t need to guess your way through taxes → Book a consultation call now!

9 Steps to Get the Largest Tax Refund Possible

Here’s a quick checklist to act on now:

- Recheck your tax identity: Life changes like marriage, job switches, or caregiving can unlock new deductions and credits; review them yearly to maximize tax refund outcomes.

- Compare filing status options: Run refund scenarios for each eligible status. Filing as Head of Household or separately could save more than filing jointly.

- Rethink income sources: Shift side income or dividends into tax-advantaged accounts to reduce taxable income and increase your refund.

- Time your expenses wisely: Prepay tuition, donations, or medical bills before year-end to claim them on this year’s return.

- Track overlooked deductions: Deduct mileage for volunteer work, supplies for your side gig, or online course fees you self-funded.

- Customize your withholding: Adjust W-4 settings to target your ideal refund, not too small, not too large.

- Stack credits strategically: Combine credits like the EITC, Child Tax Credit, and Saver’s Credit by staying under income thresholds.

- Use state-level opportunities: Check for renter credits, 529 deductions, or local energy incentives in your state tax return.

- Make refunds part of your plan

Tie your refund to financial goals such as debt, investing, or savings for real growth.

Keep More of Your Money with Hopkins CPA Firm

The IRS won’t give you more money unless you ask for it through proper credits, deductions, and filing. But you don’t have to do it alone.

Hopkins CPA Firm is here to guide you!

- We dig deep to find every legal credit and deduction that fits your situation.

- Our team stays updated on the latest IRS changes to boost your savings.

- We offer year-round tax advice tailored to individuals, freelancers, and small businesses.

With us, you file smart and stress-free while keeping more money in your pocket. Contact us today!

FAQ

How to maximize your tax refund in 2025?

Claim all credits and deductions you qualify for, file early, and avoid errors. Use E-file and direct deposit. Consider working with a pro.

Ways families can increase their refund?

Families should

- Claim the Child Tax Credit.

- Qualify for the EITC.

- Use the Child and Dependent Care Credit for daycare or after-school costs.

- Deduct contributions to a 529 education plan and tuition tax credits.

- Opt for ‘Head of Household’ status if eligible.

Should you itemize or take the standard deduction?

The standard deduction for 2025 is high and the easiest to claim. Itemize only if total eligible expenses (state taxes, mortgage interest, charitable gifts) exceed that amount.

- Itemizing suits homeowners or families with significant deductions, such as medical bills, that exceed 7.5% of their adjusted gross income (AGI).

- Self-employed individuals often benefit from itemizing business-related expenses.

Compare both methods each year based on personal expenses to choose whichever gives a higher refund.

What is the EITC, and how can it help your refund?

The Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income workers.

- The amount varies by income, filing status, and number of qualifying children.

- Childless workers aged 25–64 can still qualify, though credit amounts are smaller.

It helps boost refunds and is refundable. Many eligible taxpayers miss out, so check eligibility.

How to get a bigger tax refund without dependents?

If you don’t have kids, you can

- Claim the Credit for Savers.

- Qualify for the EITC even without kids if you’re between 25 and 64 and meet income rules

- Deduct HSA contributions if you have a high-deductible health plan.

- Deduct student loan interest and consider energy credits (EV, solar) if eligible.

Max out pretax retirement accounts (IRA, 401(k)) and increase withholding to create a larger refund later.